The Executive Guide to Proposal Software Selection: Risk, ROI, and Adoption

Beyond feature checklists: How to evaluate proposal automation platforms based on organizational maturity, compliance needs, and long-term TCO.

Executive Summary

Proposal software is a specialized category of sales enablement technology designed to automate the creation, delivery, and tracking of sales documents. Unlike generic document editors, these platforms integrate directly with CRM systems (like Salesforce or HubSpot) to pull accurate pricing and customer data, ensuring consistency and reducing legal risk. For decision-makers, the primary value lies not just in "speed," but in governance—controlling what sales reps promise to clients while capturing engagement data that predicts deal closure.

Why Proposal Software is a Critical Governance Decision

In my 15 years of advising B2B organizations on software procurement, I have rarely seen a tool that sits so precariously at the intersection of revenue and risk. Proposal software is often marketed as a productivity tool—a way to "send quotes faster." While true, this framing misses the strategic imperative.

When a sales representative sends a PDF or a Word document, that file becomes a "dark asset." You cannot track who opened it, you cannot verify if the pricing terms were modified after approval, and you have no audit trail of the negotiation. Proposal software solves the "Shadow IT" problem of sales contracting. It forces a standardized workflow where legal terms, pricing logic, and brand assets are locked down by administrators, yet flexible enough for reps to personalize.

Therefore, the decision to implement this technology should not be driven solely by the sales team's desire for speed, but by the organization's need for contractual integrity and revenue predictability.

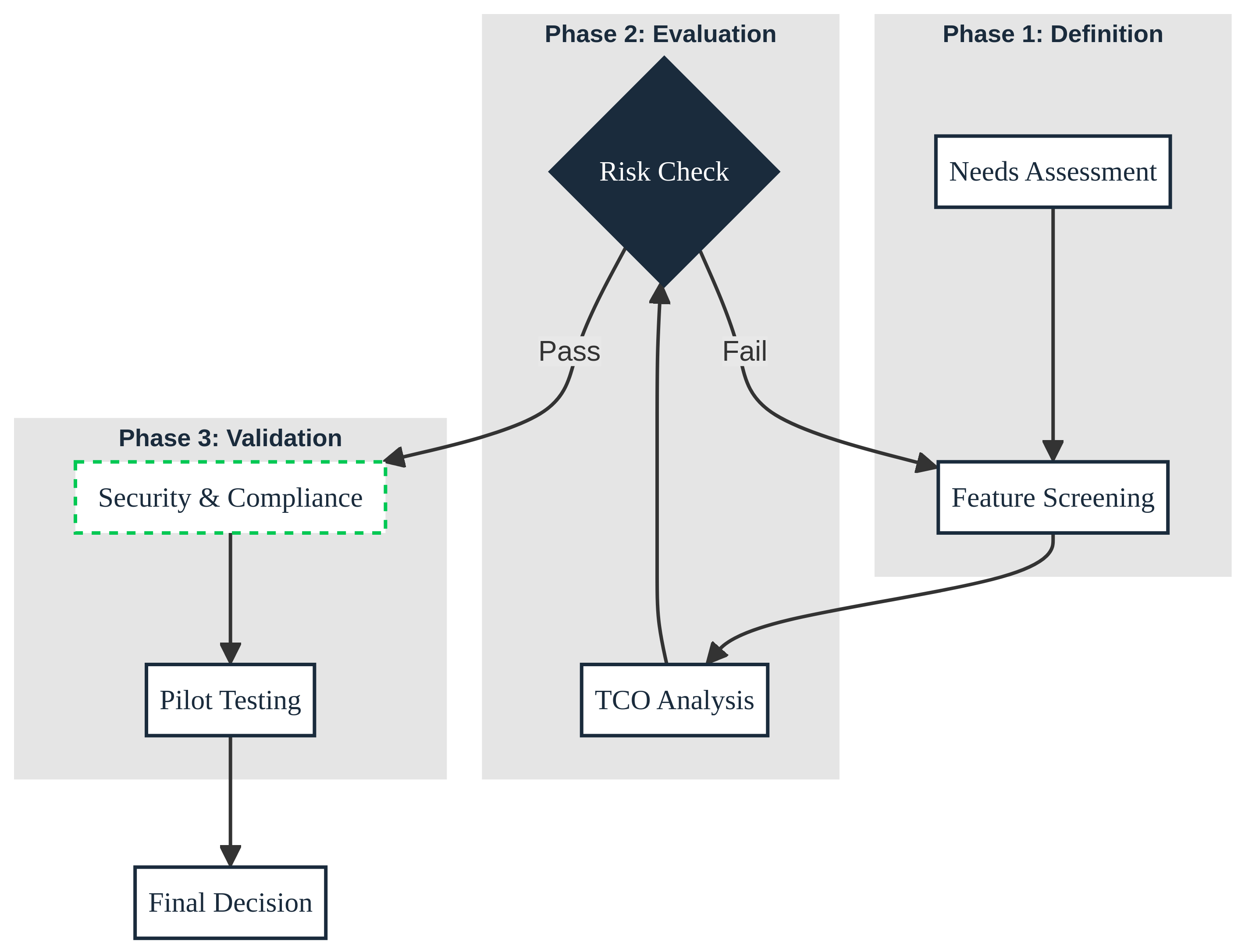

The Evaluation Workflow: From Needs to Negotiation

Most failed implementations stem from a "feature-first" mindset. Teams compare feature matrices—"Does it have e-signature? Yes. Does it have templates? Yes."—without mapping these features to their actual deal rhythm. A robust evaluation process must reverse this logic.

1. Audit Your Content Velocity: Before looking at vendors, analyze your last 50 deals. Did you send standard pricing tables, or complex Statements of Work (SOW)? Tools that excel at quick quotes often fail miserably at multi-page, redlined SOWs.

2. Define the Integration "Must-Haves": "Integrates with CRM" is too vague. You need to ask: Does it push line-item data back into the CRM opportunity? Or does it just save a PDF to the notes field? The difference determines whether you can run accurate revenue forecasts later.

3. Stress-Test the Editor: This is the most common point of failure. Have your least technical sales rep try to build a proposal from scratch during the trial. If the editor feels like a rigid web form, adoption will plummet. If it feels too much like an unconstrained canvas, brand consistency will suffer.

Critical Decision Factors: Beyond the Price Tag

When evaluating vendors, look for these often-overlooked differentiators that significantly impact Total Cost of Ownership (TCO):

- Pricing Structure Scalability: Many vendors charge per "seat." This works for small teams but becomes punitive as you scale. Watch out for "viewer" licenses. Some platforms charge for managers who just need to approve proposals, which can balloon costs unexpectedly.

- Template Management Architecture: Can you update a legal clause in one master place and have it propagate to all active templates? Or do you have to manually edit 50 different templates? For enterprise teams, the latter is a non-starter.

- Analytics Granularity: Basic tools tell you "Client viewed proposal." Advanced tools tell you "Client spent 4 minutes on the Pricing page and 0 minutes on the About Us page." This insight is crucial for diagnosing stalled deals.

Suitability by Organizational Scale

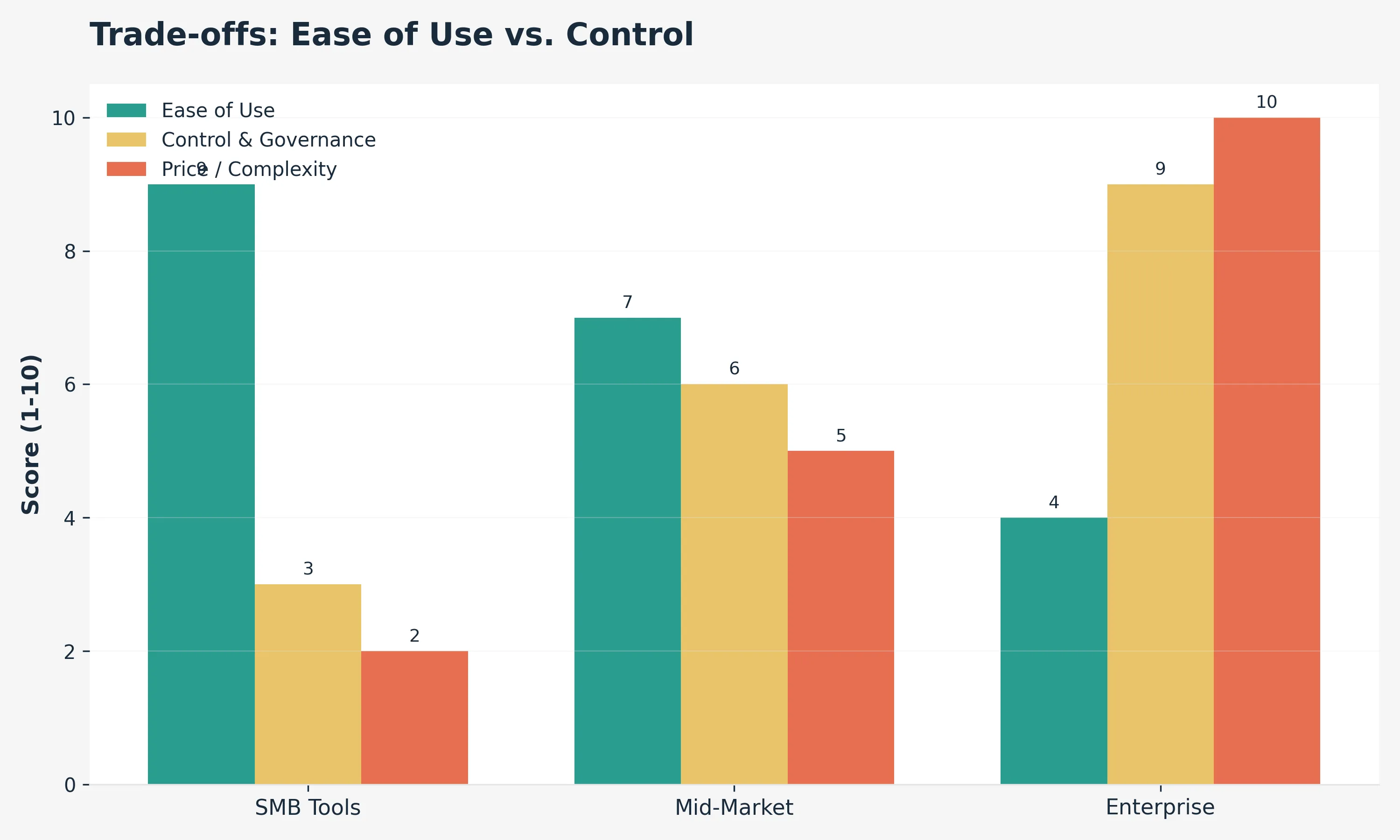

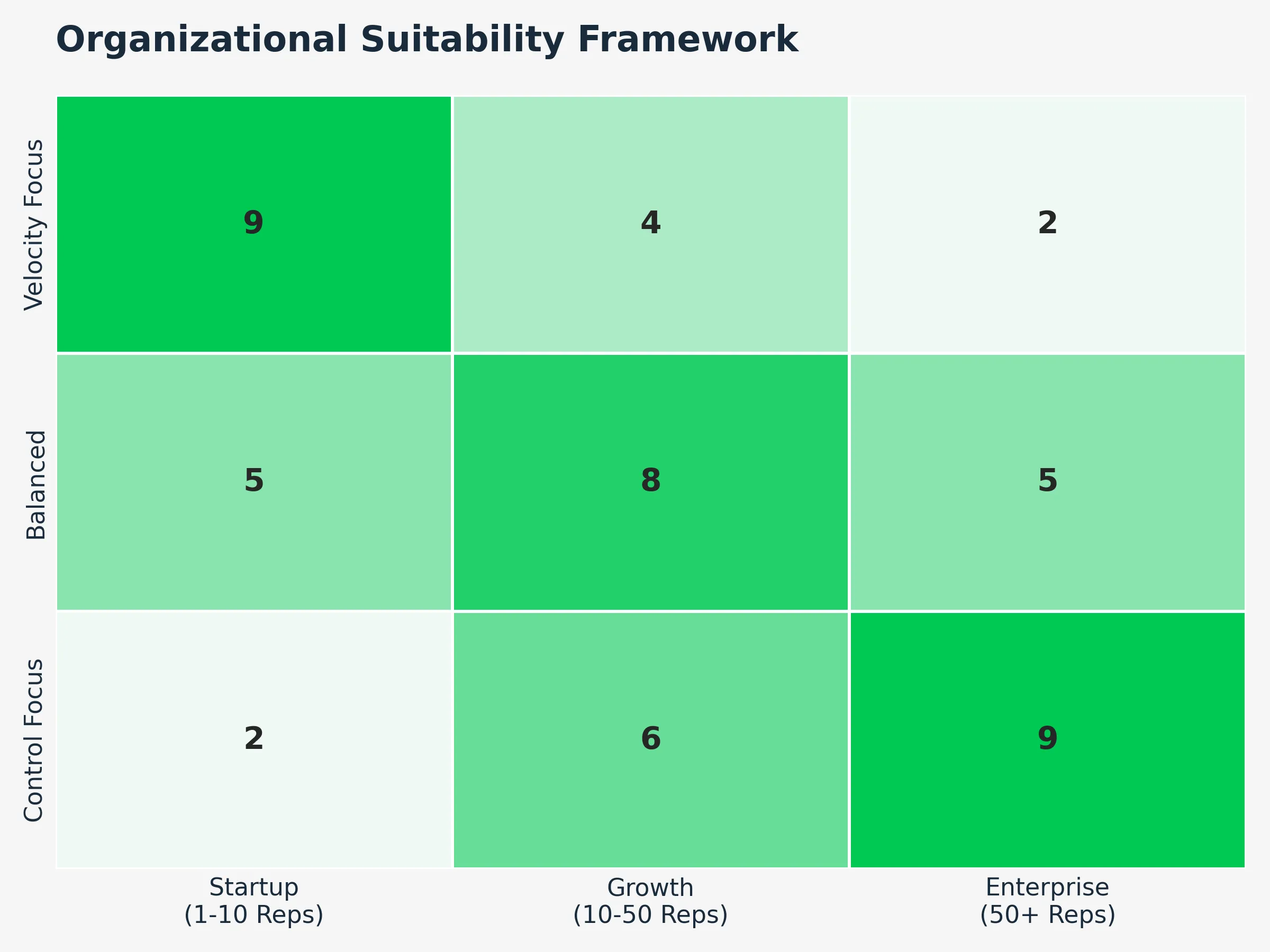

One size absolutely does not fit all in this category. The market is bifurcated between "velocity" tools and "complexity" tools.

SMB & Growth Stage (Velocity Focus)

For teams of 5-50 reps, the priority is speed and ease of use. You likely have a simple product catalog and standard pricing. Tools that offer a "drag-and-drop" experience with built-in e-signature are ideal here. The goal is to remove friction. Avoid heavy CPQ (Configure, Price, Quote) tools that require weeks of implementation; they will slow you down.

Mid-Market & Enterprise (Control Focus)

For organizations with 50+ reps, multiple product lines, or complex approval hierarchies, "ease of use" takes a backseat to "configurability." You need role-based access control (RBAC), single sign-on (SSO), and robust audit logs. Here, the ability to lock down specific content blocks (e.g., preventing reps from changing payment terms) is paramount. You can explore specific tool comparisons in our Vendor Evaluation Matrix.

Compliance, Security, and Data Sovereignty

In today's regulatory environment, where your data resides matters. If you are selling to EU customers, ensure the vendor offers GDPR-compliant data residency options. Do not assume US-based SaaS providers automatically meet these standards.

Furthermore, examine the vendor's SOC 2 Type II report. This is not just a badge; it is evidence that they have controls in place to protect your sensitive pricing data. Vendor lock-in is another hidden risk. Ask the vendor: "If we leave, in what format can we export our historical proposal data?" If the answer is "individual PDFs," be prepared for a painful migration.

Frequently Asked Questions

Is proposal software the same as CPQ?

No. CPQ (Configure, Price, Quote) software focuses on the complex logic of pricing rules and product configurations. Proposal software focuses on the presentation, content management, and document tracking. While they overlap, CPQ is about "calculating the right price," while proposal software is about "telling the value story."

Does it replace Docusign or HelloSign?

Usually, yes. Most modern proposal platforms have legally binding e-signature capabilities built-in. However, for complex enterprise contracts requiring multiple signers and specific certificate authorities, a dedicated e-signature tool might still be necessary.

How long does implementation take?

For SMB tools, you can be up and running in an afternoon. For enterprise-grade platforms requiring CRM integration and template migration, expect a timeline of 4-8 weeks to reach full adoption.

Final Thoughts: Rationalizing the Choice

The "best" proposal software is not the one with the most features, but the one that aligns with your team's content maturity. If your team struggles to write basic value propositions, a complex tool won't fix that—it will just automate bad proposals. Start by defining your ideal sales process, then select the tool that enforces that process with the least amount of friction.